Meta Platforms (Formerly Facebook) Stock Analysis

Is this really the end for the cute little blue icon?

Disclaimer: This write-up is solely for informational and educational purposes. Always do your own research and invest at your own risk. This is NOT a buy or sell recommendation - and it’s purely my own opinion.

Besides, why would you listen to a random guy on the Internet?

Meta Platforms Inc. (Formerly known as Facebook) is a US tech giant that every investor has come to be very familiar with over the years (for both good and bad reasons). It’s the world’s largest social network that needs no additional introduction. I will attempt to break down the business in a concise, yet comprehensive manner (yes, it’s slightly oxymoronic, but life is full of challenges) - and since it is already a household brand, I will spend more time shedding some opinions on the challenges plaguing the company today. For the most part, I largely disagree that this is the “Yahoo Moment for Facebook” and these short-term headwinds will not have a fundamental impact on the long-term value creation for shareholders, although many seem to think otherwise.

Overview of Meta Platforms Inc.

Facebook was founded in 2004 and was listed on the NASDAQ on 18th May 2012 with an IPO price of US$38. As of the writing of this article, 19th June 2022, Meta is currently trading at US$163, achieving a 328% return over 10 years, and that’s a 15.63% CAGR. Not too shabby if you were to ask me! However, for investors following the company, it’s currently trading near its 52-week low, and in comparison to its all-time highs of $376, the current price is a 56% haircut. So what went wrong?

For context, even though we are under the assumption that buying into a stock represents buying a small ownership of a business, in Meta Platform’s case, they have 2 classes of shares: A and B. Class B shares have 10 votes per share while Class A common stock has 1 vote per share, and retail investors like us are only allowed to buy Class A shares. And as you’ve guessed, Mark Zuckerberg himself is a control freak (if I can put it), and he owns nearly 360 million Class B shares, and through other agreements, his exposure totals to around 392 million Class B shares out of the total of 440 million. So in theory, you do own a small ownership of the business, but practically, you can’t do anything if Mark decides to pursue a different path (that might or might not be shareholder-friendly). What a great way to start the analysis.

Facebook’s mission has been to “give people the power to build community and bring the world closer together”. I will address why it gets tricky in the later part.

Meta Platforms as a company has built and acquired many brands along the way as follows:

Facebook & Messenger (built in-house)

Instagram (acquired for US$ 1 billion in 2012)

Whatsapp (acquired for US$ 19 billion in 2014)

Oculus (acquired for US$ 2 billion in 2014)

In retrospect, the Instagram and Whatsapp acquisition was instrumental in securing and entrenching Meta’s position as the go-to social media platform.

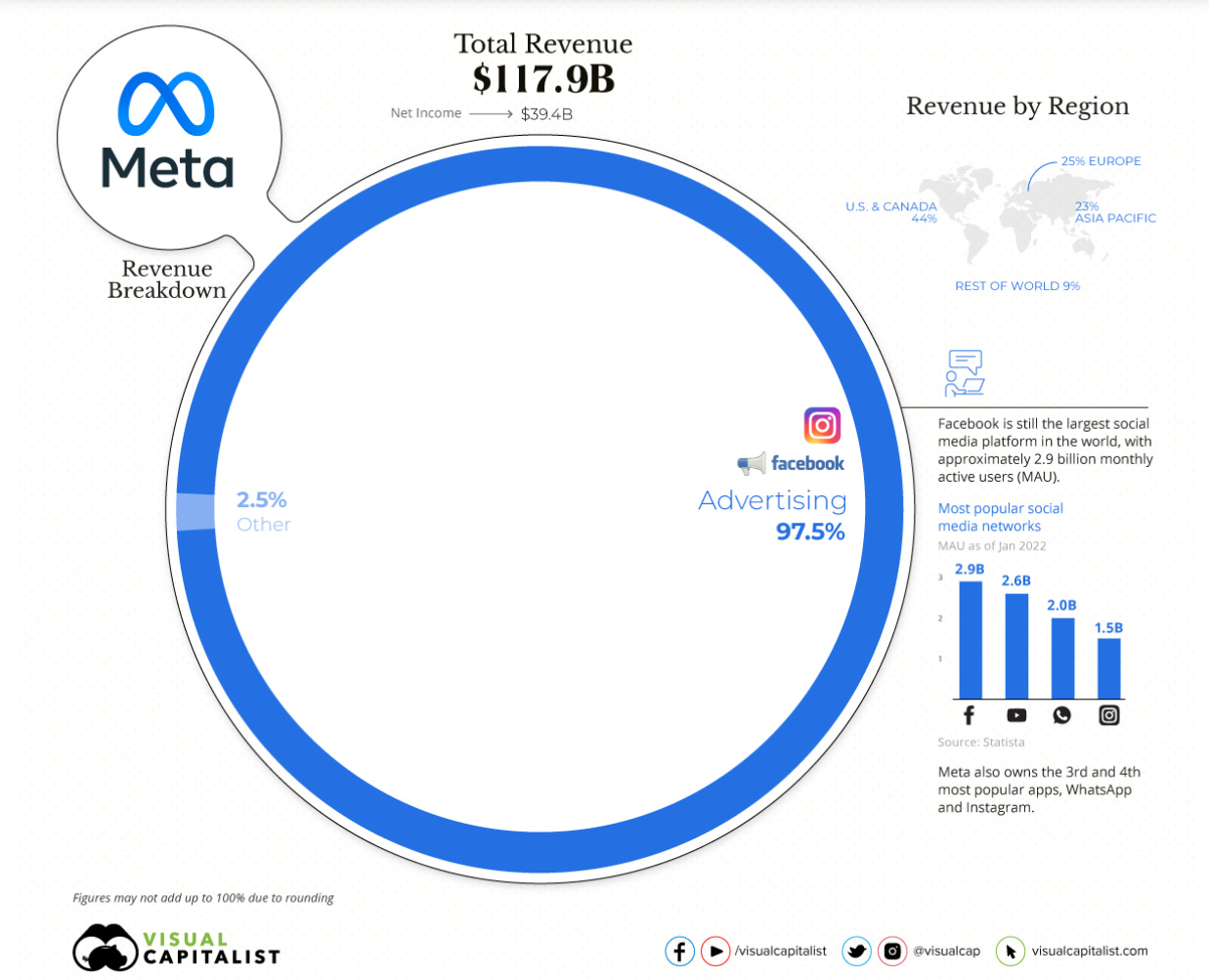

Meta’s current business model just revolved around 1 word. Advertising. I’ve attached an infographic from Visual Capitalist for your reference.

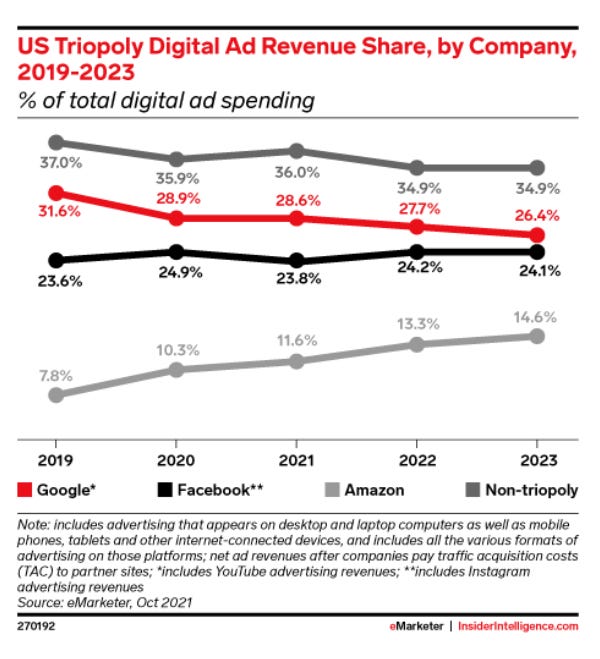

97.5% is a staggering figure. You can see this as a glass-half-full or half-empty situation. The downside is, the business is too reliant on one value driver. The upside is, they manage to scale to the extent that it currently runs a duopoly alongside Google (with the parent company Alphabet), and compared to when they just IPO-ed back in 2012, they’ve managed to 23x their revenue from 5B to 118B today. On a similar note, other prominent social platforms like Twitter (founded in 2006), and Snapchat (founded in 2011) dwarfs in comparison. Don’t worry, I will be dedicating an entire section to Tiktok in the latter part of this article. Presently, Facebook is still the largest social media platform with approximately 2.9 billion monthly active users, and Meta still owns 3 of the 4 most popular apps.

Looking back, Facebook had an incredible growth story. That’s without a doubt. Then, the next question that comes knocking on the door would be, there is a finite number of human beings on this planet that can create an account. 2.9 BILLION is a staggering number. What’s next?

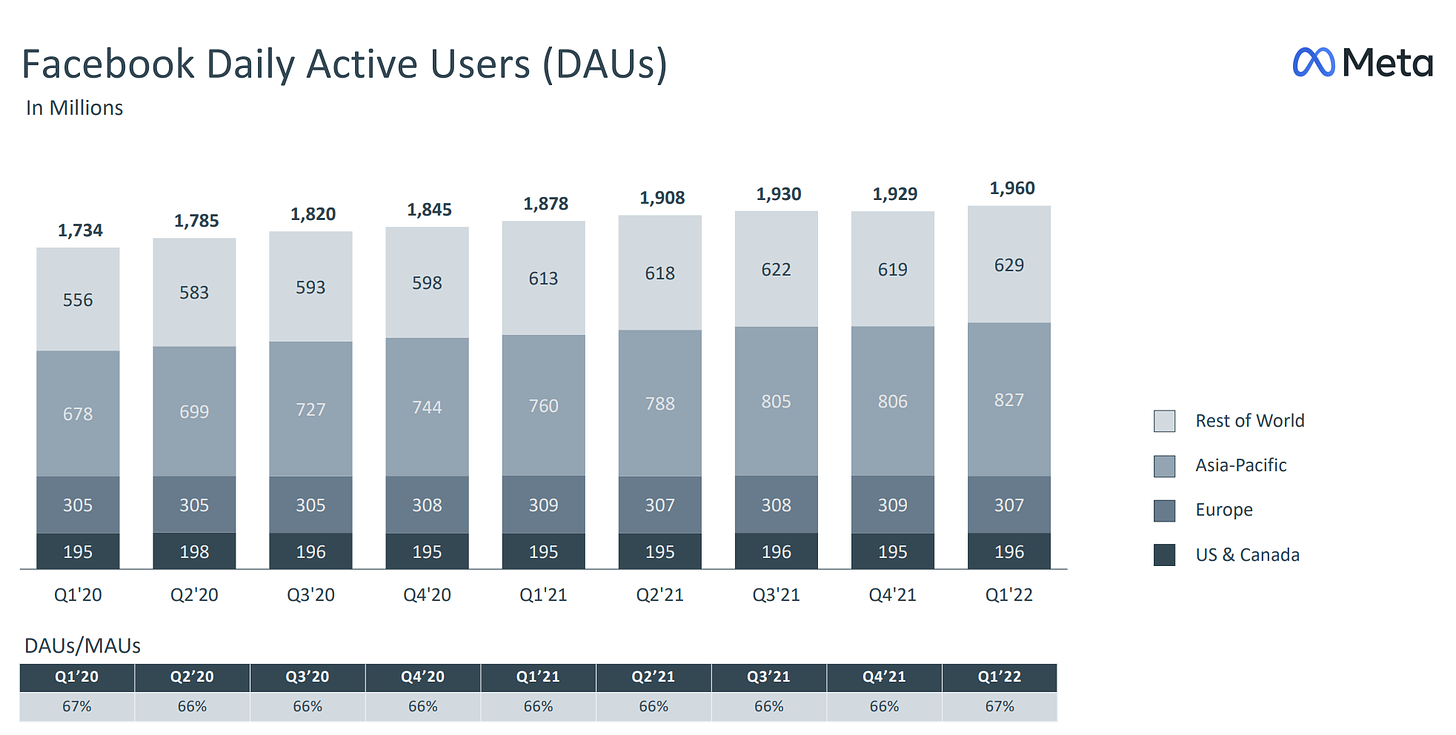

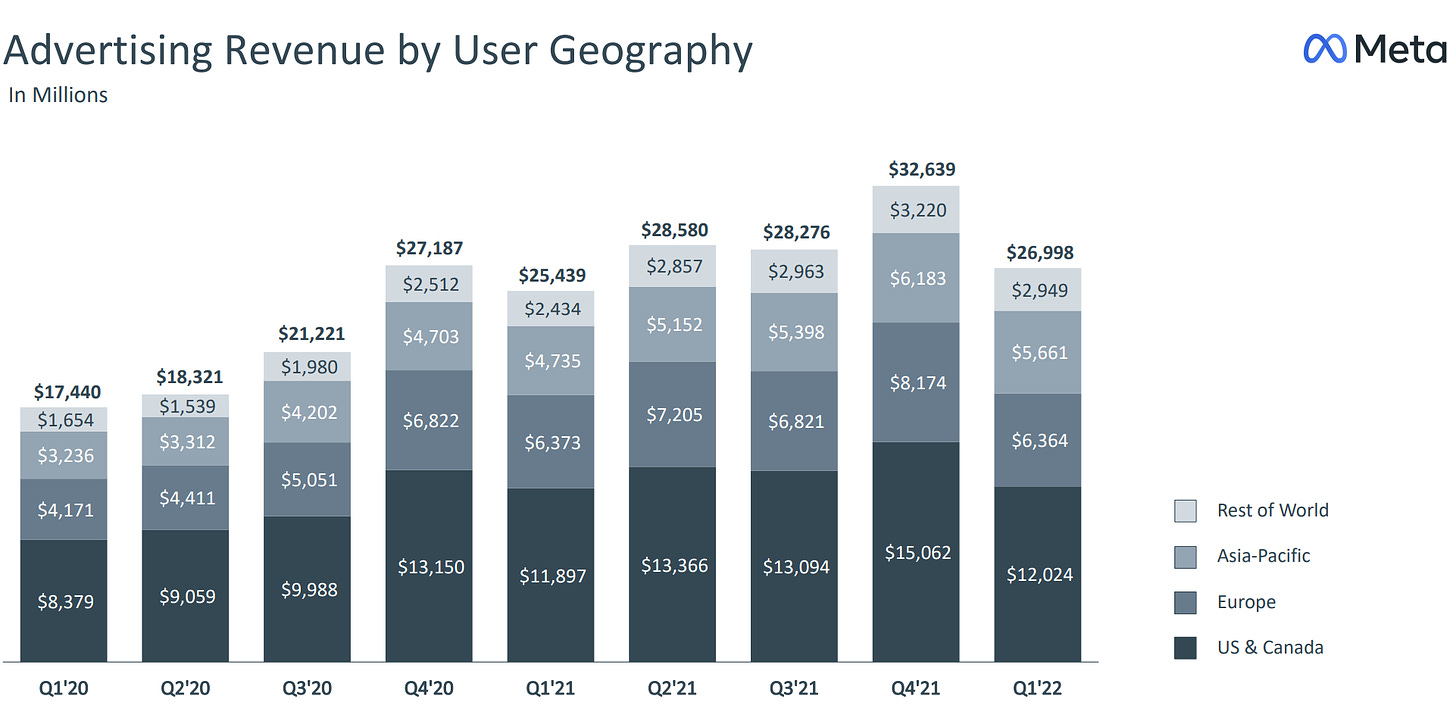

If we were to actually pry into the geographical distribution;

You can observe that the penetration into US & Canada and Europe have largely remained stagnant.

You can also observe that - despite US & Canada making up only 10% of the DAUs, they actually make up 44.5% of Advertising Revenue by Geography. Followed by Europe (15.55%) making up 23.57% of Revenue, Asia-Pacific (42.19%) making up 20.97% of Revenue, and RoTW (32.09%) making up 10.92% of Revenue.

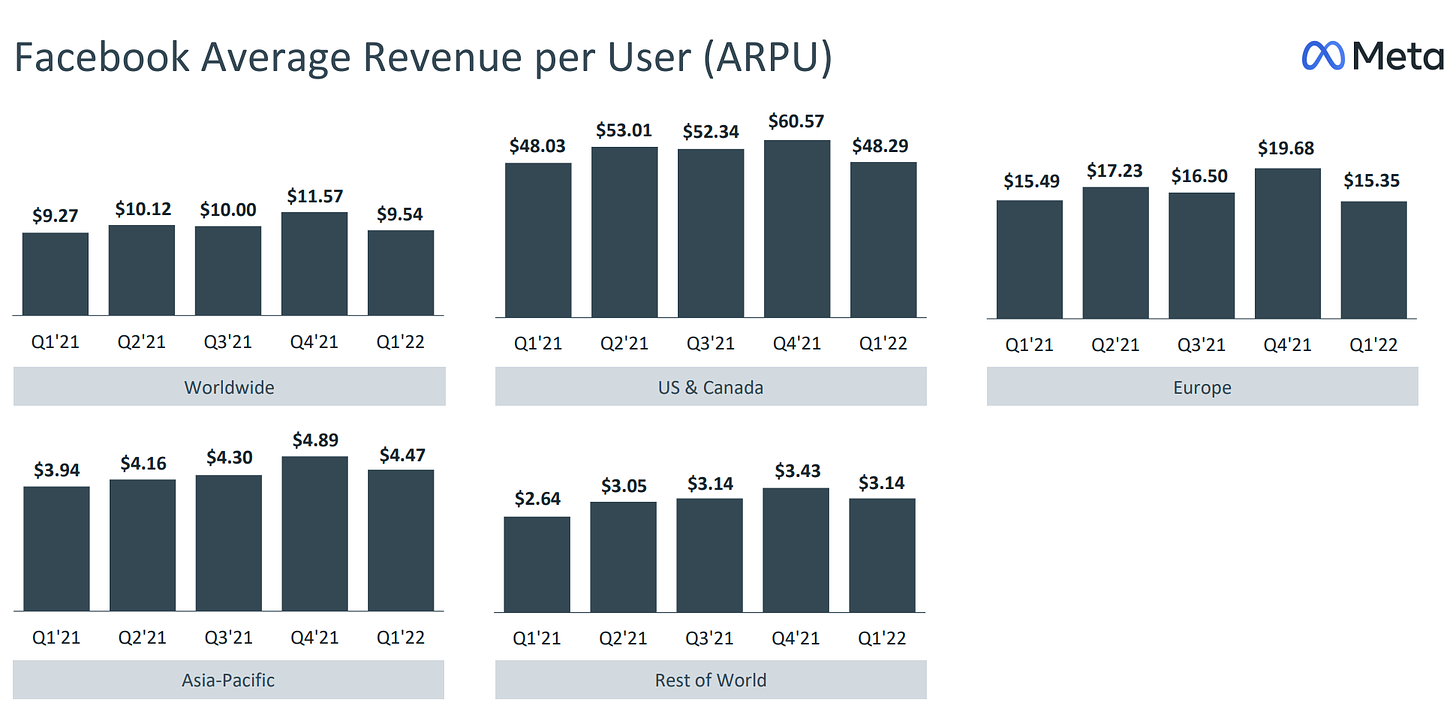

If we were to pry open the trajectory of ARPU - It’s clear that Facebook has reached some sort of “soft-cap” in terms of charging for advertising in both the US & Canada and Europe region.

The good news is, there IS still room to grow. Judging from the trendlines of growth for DAUs, the bulk of the growth came from the Asia-Pacific region. Being in the APAC region myself, I think that the industry is far from maturing. In fact, we are only at the start. Also, you can observe that Facebook has been aggressively ramping the ad rates up. In the longer term, they are even expanding their reach and network by building undersea cables around Africa to boost internet access (in hopes of capturing the African market in the distant future). At least in the near term, the APAC region will prove to be critical in terms of driving both top-line growth for users and by extension, advertising revenue.

The bad news is, we will no longer experience the tremendous growth Meta managed to deliver over the last decade; at least on this advertising front. Hence, pivoting to the metaverse might be seen as a necessary evil (or at least, another business unit for Meta to grow into).

To update you (in case you haven’t been following), one of the investors’ core concerns when Facebook reported its Q4’21 results was that “Facebook loses users for the first time in history”.

Facebook lost daily users for the first time in its 18-year history - falling by about half a million users in the last 3 months of 2021, to 1.93 billion… The loss was greatest in Africa, Latin America and India, suggesting that the company’s product is saturated globally.

Meta’s stock price had plummeted more than 26% by Thursday afternoon, shaving $220 billion off its market value.

Fortunately or unfortunately, Meta managed to turn things around in Q1’22 by reporting modest growth in users again, dispelling the concern that Facebook has already reached max saturation. As I suggested previously, I think the APAC region is a sleeping giant, waiting for a catalyst to unlock its value.

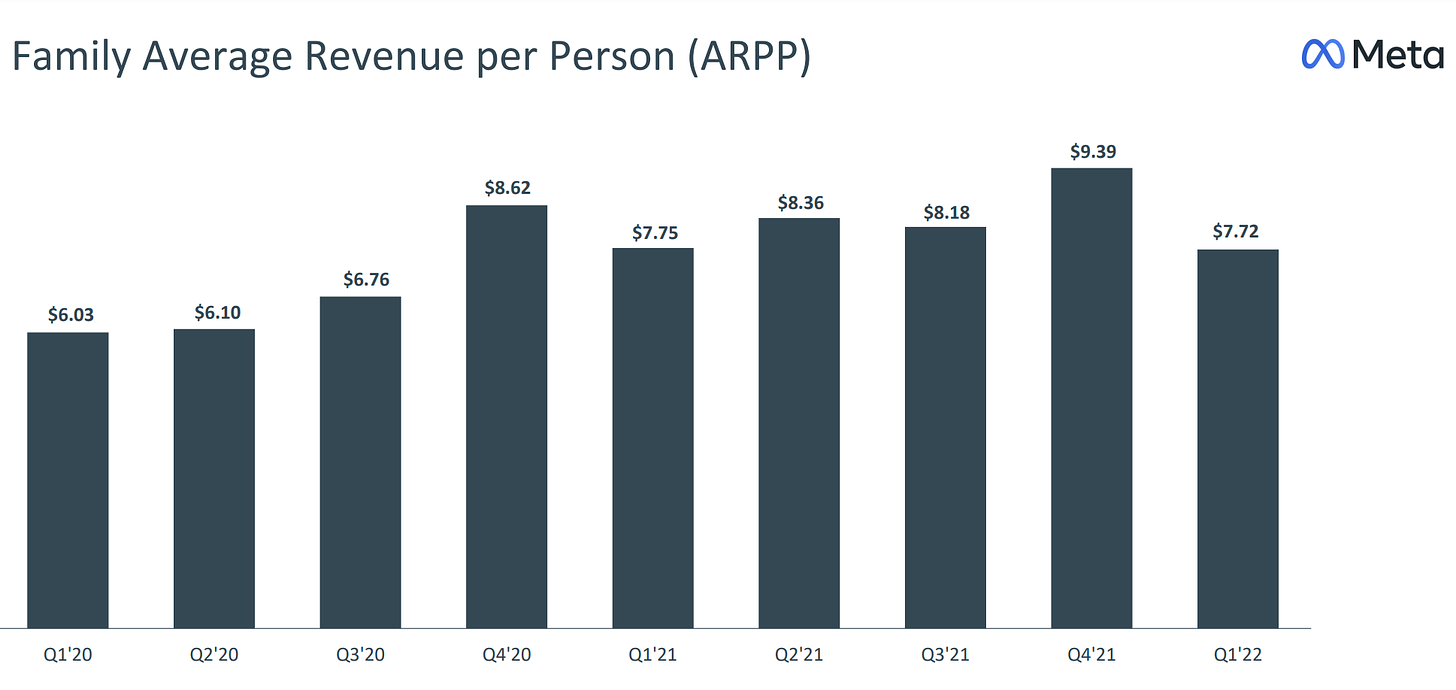

That being said, if we were to look at Meta’s entire Family of Apps average revenue, it does seem like there were troubles driving ARPP up.

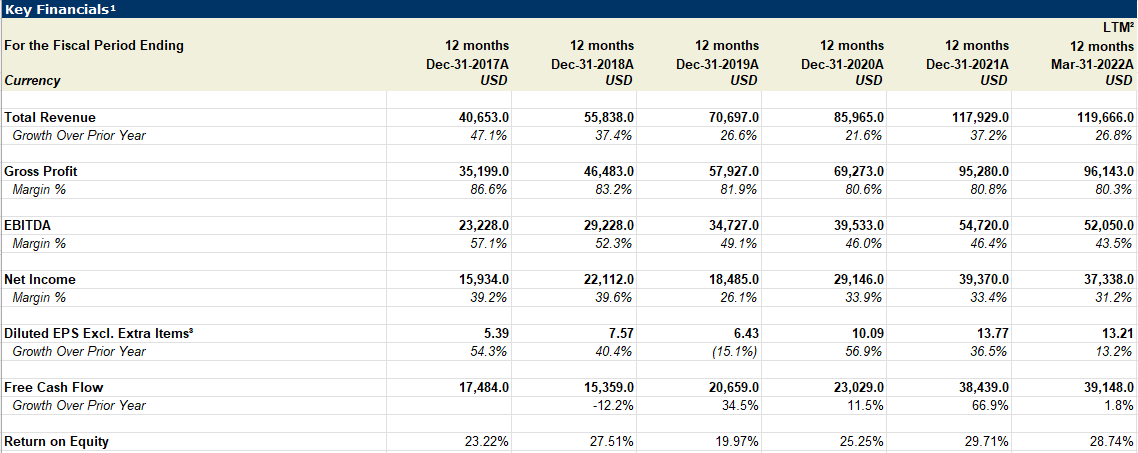

Meta’s Financial History

Meta had a fantastic run over the last decade. This sort of growth, over such sustained periods, is worth salivating for. However, the stock market is forward-looking, and so are investors. The current projections for Meta’s growth look gloomy, which explains the collapse in valuation. Projecting out through 2024, analysts are expecting Meta Platforms to be growing somewhere between 7% - 15%, and clearly, it’s no longer sufficient to excite growth investors, and henceforth, the removal of a “growth premium” attached to the stock.

Now, price is what you pay and value is what you get. Surely there would come a time (price) when Meta Platforms provide an interesting risk-reward opportunity. However, before I dive into the projections and valuations for the company, I always believe in understanding the story behind it first, especially if it’s a tech company. If it’s a failing business, with no potential reversal, and revenue just keeps scaling downwards, why would any sane investor own it? So let’s discuss the 5 curses that plague Meta Platforms today.

5 Curses of Meta Platforms Today.

Regulatory Risks (Anti-Monopoly & Adverse Impact on Population)

The $10 billion Apple Problem

Competition (Tiktok), Meta’s Yahoo! Moment

The (what?)-verse

Upcoming recession and earnings revision

1. Regulatory Risks (lawsuits after lawsuits)

As far as Meta Platforms and Mark Zuckerberg is concerned, there’s nothing short of regulatory and public scrutiny. This journey that Mark is on, is an extremely treacherous one, especially running a social media company.

It started with a full-fletched suit against Mark and Facebook, claiming that he stole the idea, source code, and business plan in 2003 while working as a programmer for another social networking site called ConnectU.com, run by 3 former Havard students. For those of you who want a quick TLDR of what transpired, this video where Brad interviewed Divya Narendra (one of the 3) provides very good context and summary, and on top of that, an added bonus of understanding Meta’s DNA and why Narendra still has a vested interest in Meta Platforms, even after getting “rug-pulled” by Mark Zuckerberg some 20 years ago.

Following that, the next high-profile case surrounding Facebook was the Cambridge Analytica Scandal that occurred in 2018. Following which, Mark Zuckerberg appeared before Congress on multiple occasions for a multitude of different reasons from anti-monopoly, user safety, instigating a riot and the list goes on. In fact, The Wall Street Journal even has a 17-point consolidation titled “the facebook files”, as to how toxic the Company is.

Bottom line is, even after spending quite a bit of time looking through the archive of events Meta was embroiled in, I can only make the conclusion that this will not be among the last. Hence, if you’re uncomfortable with this fact, stay away.

For those of you who are still here, I have good news. Before I get to the good news, I would urge serious investors to watch the 2 interviews in full.

I understand that Mark Zuckerberg is seen as someone very “meme-worthy”, but from the 2 interviews, I promise you - it’s the start of discovering the real Mark, especially the one with Lex. In that interview, they went to great lengths to describe the predicament Mark is in, and there is no perfect answer. Heck, there is not even an answer that the majority will agree with.

This conversation struck me hard:

Lex: “You’re one of the most disliked tech leaders today. 54% unfavorable rating. Why do you think so many people dislike you, some even hate you.”

Mark: “Our brand has been uniquely challenged in the US compared to some other places, before 2016 very few months was negative, after 2016 there are very few months that were positive (*Hint, 2016 was a momentous year with the US Election)… because Facebook is not a partisan company… the net effect is that we are consistently making decisions that piss off people from both camps.”

“Because of the central place of Facebook, all of the flaws propogate to Facebook, and you’re sitting there answering some of the most difficult questions being asked of the human civilisation… Critics don’t necessarily understand how difficult the problem is, they talk about AI catching harmful stuff, but they don’t understand just the sea of data you have to deal with… any of the critics, if you just hand them the helm for a week, let’s see how well you can do.

Here comes the kicker, nobody has the answer, and this problem will only become ever more challenging as our civilization takes on great philosophical questions and Meta is the warrior at the forefront. I actually look forward to Elon Musk’s acquisition of Twitter, even though it’s currently at a standstill, and how he intends to run the company. Unless there is an alternate answer to the problem, Meta Platforms is still the best we have, and I don’t personally see how things will change anytime soon.

2. The US$10 billion Apple Problem

In the previous Q4’21 Earnings call, Meta’s CFO David Wehner said that they saw a revenue impact with iOS changes in Q4 of 2021, and it will cost Meta a whopping $10 billion in 2022 based on their forecast for 2022. They have also since accused Apple of favoring Google over app-based platforms like Facebook with its privacy policies. I mean, Google paid Apple an estimated $8-12 billion per year in exchange for making Google the default search on its devices. It’s probably seen as “the cost of doing business”, and it’s not looking pretty for Meta Platforms.

I’m not going to sugar-coat this headwind. It will have a tremendous impact on both the top-line and bottom-line. Apple’s iOS 14.5 update, released in April 2021, came with an App Tracking Transparency (ATT) feature that has affected digital advertising. As Sheryl Sandberg (ex-COO) puts it;

Apple created 2 challenges for advertisers. One is that the accuracy of our ads targeting decreased, which increased the cost of driving outcomes. The other is that measuring those outcomes became more difficult.

Given the technical prowess and capabilities over at Meta, resolving this digital advertising architecture would probably NOT be an insurmountable task (but it wouldn’t be a walk in a park either way). The last I heard, they’ve made great progress in outlining and charting the way forward to measure and attribute ads - but still not effective enough prior to the ATT update.

Qualitatively, (from my anecdotal experience, because I do have friends in digital marketing / running their own businesses, and I’m a content creator myself) running Facebook / Instagram ads are not AS attractive as before. They do have first-hand experiences with spending more while yielding lesser results. However, there seems to be an improvement over the last quarter (Q1’22).

Quantitatively, in its recent report, Meta said it delivered 15% more advertising impressions than in Q1’21, but the average price per ad decreased by 8% from a year ago. Hence, they are still in the process of refining the rate of attribution, while ushering in the new paradigm of the “Post-Privacy Ad-Attribution Model”.

The bottom line is simple, and it’s contingent on 2 critical factors.

First, do you believe Meta is able to figure its way out of this curveball thrown at them, not forgetting that Meta is still a software company at its core?

Second, is there a better alternative to digital adverts that serves the same function as Facebook / Instagram? The key distinction here is - serving the same function. For investors that think that just because of this ATT introduction, Ad spending will rush to Google or other competitors like Twitter / Snap, I just have 2 rebuttals. One, Google is more inclined toward Search / Display-based ads, while Facebook is impression-based. I’m not going to compare to Twitter/Snap because I believe their effectiveness is probably even worse than Facebook after the ATT. Two, the premise for switching out from Meta is postulated to be because of the decreased returns on ad spending. However, if assuming the case that every advertiser flocks to Google (because both Google and Meta run a duopoly on digital advertising) simple demand and supply is going to result in equally poor, if not worse, economics from the advertiser’s POV.

3. Meta’s Yahoo! Moment (Introducing…. Tiktok)

We believe competitive services are negatively impacting growth particularly with younger audiences. - CFO Dave Wehner

Tiktok was the only competitor mentioned by name. I think ByteDance (which is Tiktok’s parent company) needs no introduction. Yes, it’s taking Meta’s lunch. The million-dollar question is, to what extent and for how long?

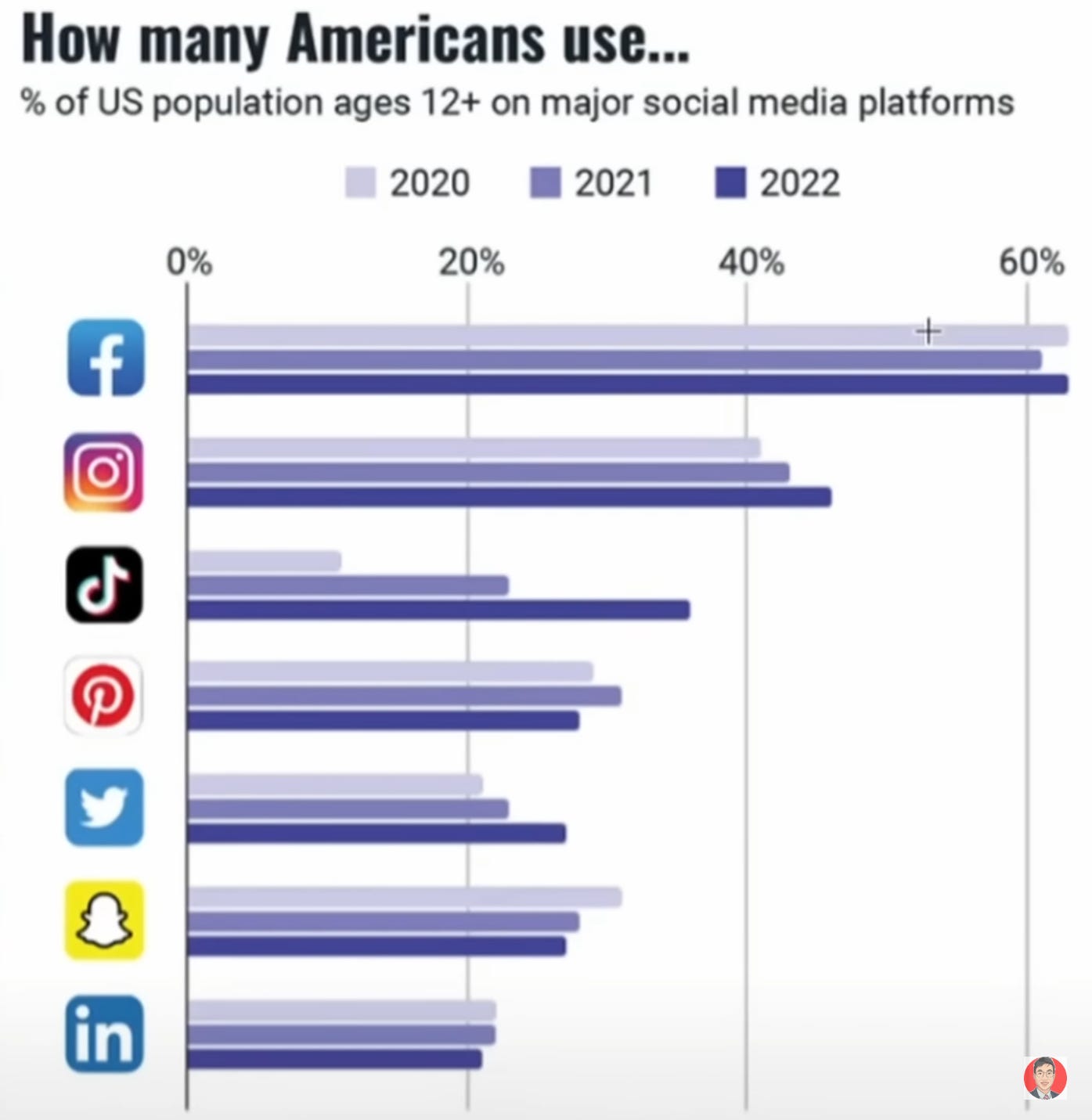

If we were to just look at the American market, given the current projection, Tiktok is going to overtake Instagram in no time. I just have 5 points to make. Bear with me.

Huge disparity in audience demographic between the 2 companies.

It’s estimated that 60% of Tiktok’s global users are under the age of 30, while 49% of Facebook’s global users are falling between the ages of 25-44. Comparatively, the older the demographic, the higher the CPM because of levels of disposable income and by extension discretionary spending.

However, I do acknowledge that it will be an increasing problem if Meta fails to continue attracting new users (especially younger ones) onto the platform - which leads to the question of longevity and relevance.Facebook vs. Tiktok Ads (From an advertiser’s perspective)

I think this video provides a rather good comparison between the 2. Long story short, they are good for different reasons (depending on the industry, type, and nature of business and audience). Tiktok ads are good for businesses that are just starting out and need a cost-effective way to advertise. Facebook is a lot more scalable and reliable. At the end of the day, businesses just want to produce results, and the return on Ads remains fuzzy at best for now. Not denying that in the future, Tiktok might be able to supersede Meta on this.The elephant in the room for Tiktok

China. Enough said. Personally, I think it’s going to be a massive headwind for Tiktok’s continued progress and development, especially as the world becomes increasingly fragmented.Download data

Given Meta’s Family of Apps, they have been and will continue to dominate the Top 10 list of most downloaded Apps. Out of the 10 in the month of May 2022, 5 belong to Meta - Instagram, Facebook, WhatsApp, Messenger, and WhatsApp Business.Meta is the only “real” social media platform

As a creator myself, for those of you who are interested I’ll drop both my Youtube and Twitter handle here, I’ve done my fair share of analysis on the different media platforms available for creators. I can observe that Meta has a structural advantage that keeps them relevant. Kinship. If I were to categorize the few largest social media platforms out there, there would be 2 broad categories. User vs. Creator focused.

Meta comes under this user-focused category, where they place a great deal of emphasis on creating THE user’s personal network ie, their friends, families, relatives etc. It’s the case for Facebook and Instagram, and also arguably Snap.

On the other hand, all other networks out there, regardless of whether is it Tiktok, YouTube, Twitter, Pinterest, or Reddit, tend to act more like entertainment platforms where users “follow” creators. I won’t follow my Mum or Dad on Tiktok just to watch them dance.

The fundamental premise of being user-focused is that it becomes incredibly sticky, and I would just like to emphasize on the word, INCREDIBLY sticky. The friction for your entire network to move bases is close to being a nightmare. The good thing is, for both Facebook and Instagram, the baseline assumption is that human beings are social creatures and we are inherently ‘busybodies’. On top of that, Meta has very cleverly built-in algorithm recommendations for Discovery, and also added Reels into the Instagram App (essentially the answer to Tiktok). Not only do they hedge their downside as being a pure-play entertainment platform that can be easily disrupted, but they also do not limit their upside in terms of enhancing the engagement on their platforms.

4. The Metaverse

Let me give this to you straight. After spending a considerable amount of time on this topic, I walked out even more confused. On the same note, I believe Mark really does have a vision in this space, but I think we are far from reaching ‘Nirvana’ any time soon. Looking at the metaverse space, so-called ‘experts’ are guessing as much as we are.

In summary, I believe that it would be incremental progress toward the ideas we are floating around now, but not to its fullest extent.

On a company level, however, we are expecting a great deal of cash burn for this ‘pet project’. It is expected that the capital expenditure for the year would range between $29 billion to $34 billion, up from $19 billion last year. Although the official account by the CFO is driven by “investments in data centers, servers, network infrastructure, and office facilities” - we don’t exactly know the breakdown to the T. We do see publications from time to time on Meta’s plan for the metaverse, such as their plan to hire 10,000 employees in EU to build the metaverse.

However, given the current macro backdrop in the world economy, it does seem like Meta is exercising prudence in an increasingly challenging world. They reportedly broke up the 300-person team that was building a hybrid VR/AR OS. They’ve also gone one step ahead to freeze hiring for the year.

In this scenario, I’m ready to give Mark and his team the benefit of the doubt to exercise extra caution and they should know how best to run the business in these circumstances. Given the track record of Meta thus far, they have exercised a great deal of judgment that created shareholders’ value.

5. Meta’s Growth in a Recessionary Environment

Increasingly, there are more chatters around an impending recession. Not going to lie, I’m also in that same camp. However, I think the extent of the recession is where most investors disagree on.

If we were to judge Meta’s current valuation. They are trading at a PE of 12 at the time of this writing. If 2022 proves to be a really bad year, or even extending it into 2023, and earnings are cut by half, Meta’s PE will double to 24. It’s simple math. So I wouldn’t be too quick to judge that Meta is a MUST BUY right now at its current valuation. However, in the grander scheme of things, recessions and economic booms are just part of the cycle. The most critical aspect of valuing the business fundamentals still relies on how accurately can you predict its future cash flows and profits.

Another point I wish to bring out, in the digital advertising space, I do agree that the general spending for advertisements will decline, but as purse strings tighten, frivolous and ineffective spending are eliminated. Hence, there will be a congregation to the top dogs. It was evident in 2020 - where ad revenue share decreased from 37% to 35.9% for those not in the triopoly (Google, Facebook, Amazon). So I would not necessarily conclude that this will catalyze the DEATH of Meta.

Valuation of Meta Platforms

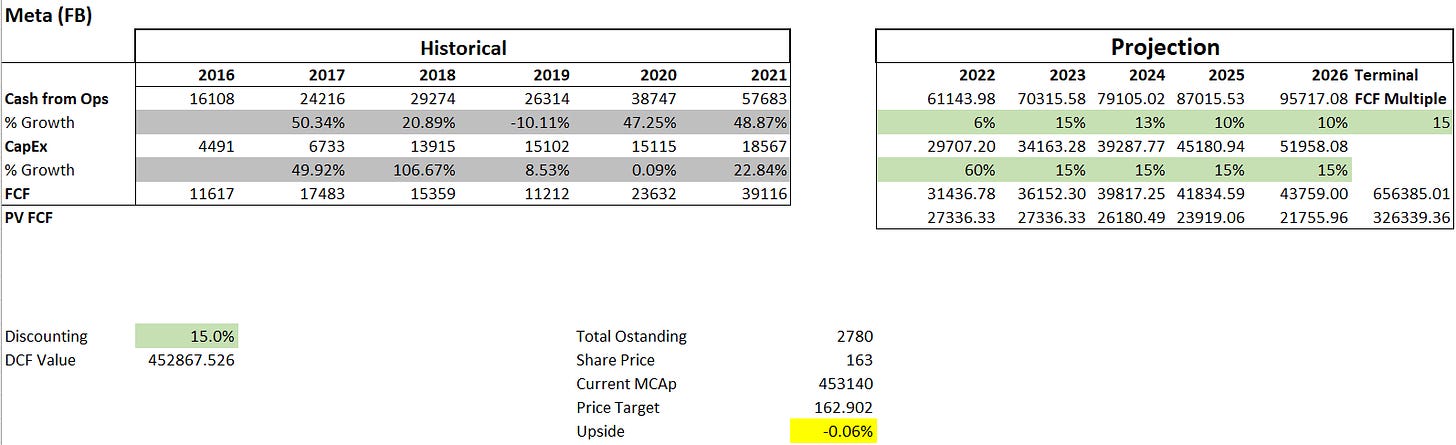

I have done a very simple, truncated version of a 5-year DCF for Meta. I’ve adopted projections (and minus 1%, to be more conservative) from analysts (because why would I think I know better) until 2024E. 2025 onwards, I’ve just let it grow by 10% for CashOp and flatline CapEx growth by 15% from 2023 onwards. The huge bump in CapEx from 2021 to 2022 was due to the guidance provided by the company to be incurring between 29 - 34 billion.

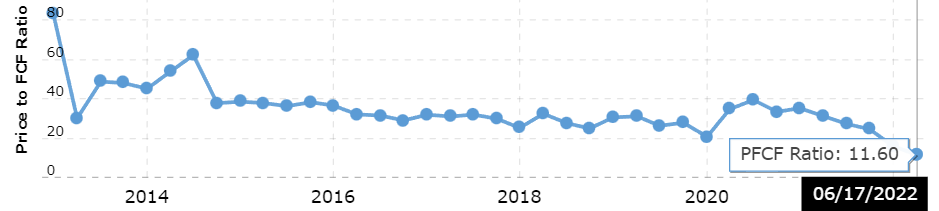

As for the Terminal FCF Multiple, Meta usually trades at around the 20 - 40 P/FCF range, and only in 2022 did it start trading under 20. Hence, I decided to use 15 for its long-term multiple.

Given that Meta is currently trading at $163, assuming that the projections on CashOp and CapEx are relatively accurate (coupled with the market giving Meta a 15 P/FCF multiple, fingers crossed), you MIGHT be able to enjoy a 15% CAGR at this current valuation. Everything is of course based on Guesstimate.

To throw in a kicker, based on Meta’s Q1’22 B/S, they currently have $43.9 billion in C&CE and Marketable securities. At Meta’s current $443 billion dollars valuation, buying the stock today will mean that around $15 of the $163 is for their cash position alone. If we were to offset the cash portion with their current liabilities account (21 billion), $8 of the $163 is in cash. Incredible.

There are 4 potential upsides that Meta shareholders might get to enjoy in the near future:

They decide to slowdown CapEx due to the conditions of the economy, coming in lower than the lower bound of their guidance of 29 billion, jacking up FCF.

Meta somehow manages to regain their footing via R&D, redesigning their ads architecture, and even exogenous factors that might delay the progress of its competitor, and growth reverts back to the mean.

They experience a multiple re-rating (probably due to investors’ excitement again)

The discounting rate of 15% is compressed as BigTech reclaims its throne again

Summary

As an investment, if you believe Meta can come back stronger, you are getting a deal of your lifetime. However, the stock is down for a reason and investors don’t think they can do it.

Love,

Chi Keng

Disclaimer: Do not interpret anything above as financial advice. As of the date the Report is published, the Author may or may not hold a position in the security mentioned. Nothing in this Report constitutes investment advice. Readers should conduct their own due diligence and research and make their own investment decisions. This is NOT a buy or sell recommendation.

haouetngguongghfff!!

Great work