First, we were sold the dream that a Trump 2.0 would be exceptional for the stock market.

Now, they’re telling us that the tariffs might trigger another round of inflation or, worse, a recession.

As I’m writing this, the S&P500 is down 1% in the pre-market and year-to-date. We’re almost flat and have given up most of the post-election excitement.

On the flip side, detractors were lining up eagerly, writing off the basket of Chinese equities – because you know, Trump was notorious for his anti-China pursuit.

Who would’ve guessed that the Hang Seng Index (tracking the Hong Kong market) would hit its 3-year high?

As you’re subscribed– I’ll give you first dips on my current thoughts & my most recent transactions.

General Thoughts on the Current Market Volatility

· I was not necessarily very surprised with Trump doing Trump things, since this is not the first time we’re trying to “deal” with him. I was more surprised by how optimistic the market participants were after his election. He’s convinced them well.

· Yes, we’ve given up most of the post-election gains, but I still don’t think the general US market is at “bargain territories”. Yes, there could be buying opportunities here and there, but it depends on your current portfolio allocation, and I would think to buy slowly, rather than going in with the entire kitchen sink. Let that sink in.

· Volatility is expected – and extra volatility is the upsize package that comes together with the Trump package. Mr. Market is here to serve you, not command you.

· I’m (seriously) NOT a fortune teller. I can’t make (accurate) predictions about whether we’re heading towards a recession, and I don’t want to. Yes, we can all have our view… but I don’t think that should form a big part of our investing strategy (unless you’re trading macro).

· I hope for long-time followers, you’ll resonate with my consistent messaging.

o Focus on understanding the companies in your portfolio,

o Consistently do your bottoms-up analysis,

o Look into their valuations & implicit assumptions,

o And this too shall pass.

o The market’s fear is your opportunity.

What I’ve been doing

For those that follow me on YouTube, you would’ve known that I pulled the trigger on Meituan some time back, and I’ve outlined my thoughts in this video. At that time, markets were spooked by JD.com’s announcement into the food delivery business, while declaring an open war by eliminating commissions to establishments that join them before May.

I’ve made the assessment that JD’s entry into the space would not affect Meituan’s lead, and in fact, decided to double down sometime later when they experienced another round of pullback on the 25th of Feb.

For the rest of my Hong Kong positions, I’m holding steadfast onto it. Let’s see where the HK market can go.

For SINGAPORE investors, interested in getting lifetime commission-free trading for both US & HK stocks, Longbridge is a new broker in town (regulated by the Monetary of Singapore) – offering MASSIVE sign-up promotions for new users…

· Deposit SGD 2000, maintain for 30 days and complete 3 buy trades to get 1 NVIDIA Share

· You’ll also receive a BONUS USD 50 worth of Option Cash Coupon (after depositing SGD 2K)

· AND an exclusive SGD$18 Cash Coupon if you sign up with my link!

If you’re not taking advantage of this welcome promotion – then I think you shouldn’t be on this list. (Just joking, I still love you greatly ok!)

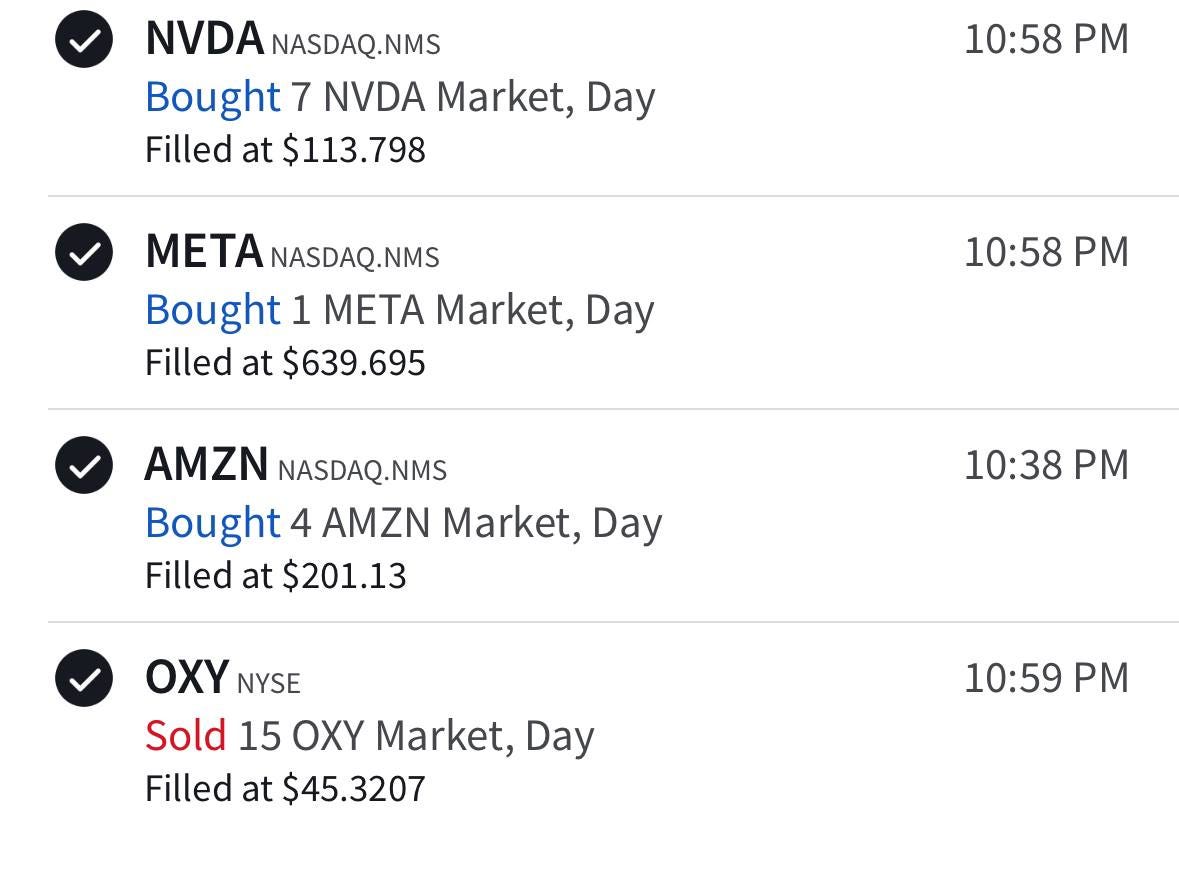

For my US portfolio, I’ve recently decided to sell OXY, added to Meta and Amazon, and started a new position in NVIDIA.

I know, you must be SHOCKED that I’ve become an NVIDIA shareholder, especially at current valuations. I think this deserves a whole-ass video on it’s own to explain myself. You can probably look forward to that, where I’ll be going into greater detail explaining my current thoughts around the Magnificent 7 stocks.

For OXY, it was a position that was less than 0.3%, and I was not making much progress in terms of my understanding & my conviction to double down, hence I decided to cut it out.

For Meta, I’ve sold out a third of my position previously (at ~$725/share) to cover a majority of my cost base and will slowly be adding them back whenever Mr. Market decides to punish it. There’s no exact Science or Math to my approach. I’m just adding when I think I’m comfortable with the valuations (even if it’s “fairly priced”) – and I’m in no hurry to add.

For Amazon, based on my latest estimates, $200/share doesn’t seem to be extremely demanding (of course not forgetting that I have a much lower cost base, and will be averaging UP). Also, it’s bouncing around it’s 200MA. (I’ve since become a technical analysis expert too! Hah, just joking)

The bottom line.

Yes, markets are a little turbulent, but we’re still near all-time-high valuations. You need to be discerning of what you’re buying into, and I’m still in the camp that this should not be a “Buy every dip” moment. Just take your time, and let the market serve you.

I’ve recently seen many commentaries around how Buffett the GOAT of investing is hoarding onto a huge cash pile, with speculations around how he’s “waiting for the market to crash”. I don’t put too much effort into such analysis.

Especially for those of you younger folks out there (To me, anything under 40 is considered young) – you still have a good amount of earning income and time horizon. Just follow your investing plan and criteria.

For myself, I now hold roughly 8 to 12% of my portfolio value in cash (depending on whether you include my emergency cash or not). If not, I still think that we should try to stay invested as much and as long a time as possible.

Thank you for staying with me, and I hope to see you on the Moon.

Love,

Chi Keng

Hello there,

Huge Respect for your work!

New here. No huge reader base Yet.

But the work has waited long to be spoken.

Its truths have roots older than this platform.

My Sub-stack Purpose

To seed, build, and nurture timeless, intangible human capitals — such as resilience, trust, truth, evolution, fulfilment, quality, peace, patience, discipline, relationships and conviction — in order to elevate human judgment, deepen relationships, and restore sacred trusteeship and stewardship of long-term firm value across generations.

A refreshing take on our business world and capitalism.

A reflection on why today’s capital architectures—PE, VC, Hedge funds, SPAC, Alt funds, Rollups—mostly fail to build and nuture what time can trust.

“Built to Be Left.”

A quiet anatomy of extraction, abandonment, and the collapse of stewardship.

"Principal-Agent Risk is not a flaw in the system.

It is the system’s operating principle”

Experience first. Return if it speaks to you.

- The Silent Treasury

https://tinyurl.com/48m97w5e