Chinese Tech Stocks are up not 10, not 20 but 0%. Again.

Top 10 Chinese Tech Ranking, according to attractiveness

Year-to-date, the Hang Seng Tech Index went on a joy ride (from -20% in Feb to +11% in May and back to ~0% again) and remained flat in 2024.

Long-time Chinese Tech Investors are probably wondering… “Man, not again”.

I understand most Chinese investors' frustration and exasperation, especially being ‘stuck’ in this bear market for close to 42 months now…

“To buy when others are despondently selling and to sell when others are avidly buying requires the greatest fortitude and pays the greatest reward.” – John Templeton.

Of course, No One knows how the future pans out – but one thing for sure is that when there is a bear market, often, emotion runs high, and there will be indiscriminate selling.

I’ve put my money where my mouth is and added to my Tencent Position at the start of May 2024.

Other than Tencent and Alibaba (which I’ve tried to cover extensively on my YouTube channel), I’ve received multiple requests on my views of other Chinese Tech names.

Since I’ve been following most of them for quite some time now, I wondered… Why Not?

A week ago, I’ve published a video reviewing all (the important) Chinese Technology names in the market today, assessing both their business and risk (qualitatively). Catch that if you haven’t.

In this newsletter, I will attempt to rank the 10 Largest Chinese Tech names (based on their Public Market Capitalization) – and determine which is the most attractive investment opportunity today.

*accurate as of 8th June 2024

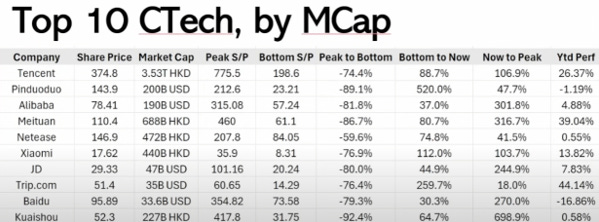

I’ve furnished the important details of the Top 10 Chinese Tech Companies according to Market Capitalization.

When looking at any investment opportunity, it’s important to look at both the qualitative and quantitative aspects. I.e. the business fundamentals, economic moat, sources of risks, history of execution, financial ratios and metrics, valuations, etc.

To not waste your time, this is my (very personal and humble opinion) ranking of the 10 Chinese Tech names, according to attractiveness today.

*accurate as of 15th June 2024

I’ve shamelessly adopted the 80/20 rule (Pareto Principle), which states that roughly 80% of the effects come from 20% of causes. To me, quality takes priority over valuations – hence the quality score will make up 80% of the final score.

Now, full disclosure, I have a significant weightage of my individual portfolio in both Tencent and Alibaba, and therefore (to no one’s surprise), they will naturally rank #1 and #2 in my list.

For both Alibaba and Tencent, I’m still confident that they offer one of the best risk-reward opportunities in the market today – not so much on the upside (like going 10x from here), but more so, the downside protection from the dividends, share buybacks, and long-term shareholders holding the fort.

When looking at the Top 2, I think most would agree that Tencent has one of the strongest moats of any Chinese company to exist to date. They’ve constructed an empire across social media, messaging, payments, gaming, advertising, cloud etc. WeChat is in a league of itself.

Alibaba on the other hand has fumbled over the last 3-5 years and are playing catch-up – not forgetting that they’ve been one of the most competitive in yesteryears. We’ve seen signs of bottoming out, and margins coming back up – but we might not be totally out of the woods yet, especially when China’s economy is still in transition. Management has publicly committed that they’re all in into AI, and has restructured their operations & process, finding back their footing.

I think having both in one’s portfolio will pretty much cover the needed exposure to the Chinese tech scene. Tencent has one of the best quality businesses anyone can own, but still trading at an attractive valuation (and in my estimate, still ~40% undervalued, at $500 - $550HKD per share).

Alibaba on the other hand, has been thrown into the gutter – with valuations trying to price them as if they’re a dying business albeit still posing high single-digit growth, recovering margins, and strong free-cash-flow producing capabilities. In my most conservative case, there is still nearly a 100% upside from here, with an intrinsic value (IV) of near $150USD per share.

For Meituan, I’ve just checked in with an acquaintance that is situated in China – the value proposition and usage is recovering very strongly. Despite the heavy level of competition from other Big Tech names, Meituan’s ability to focus and execute has been key. Today, they’re the “Everything Service” app. From food, to movie tickets, to sending flowers and even booking of hotels and tickets – they’re all done on one platform. They’ve managed to cultivate a level of flywheel that seems impenetrable (for now).

Although growth seems healthy and recovering strongly (as domestic tourism and consumption recover) – they’ve just turned profitable, with not a strong track record of delivering bottom-line growth. With the divestment from Tencent – they’re on their own and must start growing sustainably. The call to buy/sell Meituan really depends on how foresee the execution. I remain neutral (but bullish).

Moving on to Netease, they’ve been dragged into the doghouse alongside Tencent during the gaming crackdown just 2 years ago. From a business execution perspective, they’ve delivered strong numbers ~20-30% ROIC (Returns on Invested Capital), which bodes for investors, reflecting a strong and efficient use of resources.

Personally, I don’t really have a deep enough grasp of the individual gaming company – therefore I opted to go with Tencent instead, which is a much more diversified approach. Netease, being a pure-play gaming company will always be subject to unknown, unquantifiable risk. However, if we were to judge it purely from a numbers POV, Netease has delivered respectable results, and still seems attractive (undervalued ~20%, with an IV of around $110USD per share).

Pinduoduo is a thorny topic for me. I’ve expressed my opinion in the video, and although I would like to acknowledge how far they’ve come – with the clever execution of implementing social elements to eCommerce. I still reserve some level of skepticism on how they’re expanding so profitably.

For JD and Baidu, they’re both in a similar situation where the market disrespects the business – according them a very very low valuation, but arguably justified.

JD.com’s revenue has plateaued for the last ~2.5 years (in USD terms), with ROIC in the low single digits. Baidu’s EBITDA has remained the same since 2017, with not much to show for on the ROIC front (3-8%). The only good thing? Both companies have a boatload of cash and are trading at really undemanding valuations.

However, I would put a note, stating that I’m more bullish on JD.com versus Baidu. JD’s business philosophy has been constant since Day 1, and they continue to expand on their vision (serve high-value customers, provide authentic products, and be the most trusted company on earth).

Baidu on the other hand, has been lost and mismanaged over the last decade – losing out on many opportunities and growth. From a numbers point of view, both look extremely undervalued. If you point a gun at my head today to choose between the two. I would rather go for JD.com, despite the big marketing efforts from Baidu’s team on full self-driving, AI demo, etc.

I like looking at the track record. No point being the most fanciful, but not being able to deliver on your promise.

Xiaomi – has always been one of those big brands that I see in the real world, but always never able to translate it into profits in the investment world. When looking at its different verticals, they’re in places where I would never want to be in. Smartphones & Electric Vehicles. I’ve personally used some Xiaomi products before, and they’ve always pride of their “ecosystem”. From my real-world experience, there’s no eco in the system (but maybe it’s just me).

I see analyst price targets of around 10 – 20% (~19 - 21HKD per share) above current prices, but it’s not necessarily a stock I will hold for the long term, so I’ll give them a pass. Not until I am impressed as a customer.

The last two, Trip and Kuaishou have never once caught my attention. Kuaishou is a hard pass, especially when ByteDance is dominating the market. It feels to me like Snapchat, fighting against Meta.

For Trip.com, it would be a more tactical play, where interested investors would do a quick trade around the Chinese recovery story (and as they say, a rising tide lifts all boats) – but over the longer term, it seems like Meituan is surely taking over Trip’s position – and they’ve not much moat to guard against them.

In conclusion, as Asians – the minimum benchmark is to have a passing grade (i.e. 50%), so from the table above, I think you can draw your conclusions. If you’ve enjoyed this – please remember to subscribe to stay updated on my latest musings.

Moat Made Simple.

Love, Chi Keng.

So you feel that PDD’s excellent financial results are sketchy (even despite’s the temu story)?