The last two weeks have been an eye-opening moment for me – not because of the volatility that we’ve witnessed in the general market (because this is a feature of an auction-based system), but more so how many became macroeconomic experts overnight.

Especially in the realms of the Japanese Yen, central banks’ decisions, and what a carry trade even means.

I’m guilty as charged.

I did make a video to capitalize on this spike in interest.

In my defense, however, I spent around ~3 minutes of the 21-minute video talking about it.

Long story short, I couldn’t be bothered with what are the impacts of the “unwinding” (whatever that means) and was just excited about the opportunity presented to add to my existing positions.

The last time I interacted with this topic was back in my university days (I believe it was one of the foundational topics in Finance). From what I can remember, I did not focus on this idea because intuitively, there is no “free lunch” – especially in the finance world.

But in our imperfect world, such opportunities do exist - but a layperson (like myself) will find it challenging to play this opportunity. It’s a game that the institutional (or High Net Worth) investors play.

Therefore, I breezed through it.

However, from my understanding - this whole yen trade shenanigans would not have any fundamental implications on the general business environment. Instead, a small impact on general valuations (due to margin / cheap capital), but there would be a limit to that.

My guess - nothing extensive.

The lesson I learned.

Everyone is trying to grab your attention these days. Protect your sanity and know that your time is precious.

2 Interviews that will refresh your impression of Mark Zuckerberg

On the note of time being precious, I’ve come across 2 interviews that I think would have a better ROI (return on investment) on your time. They’re both around Mark Zuckerberg.

I have a peculiar interest in him as I’m a fellow (small-time) Meta shareholder.

Even for those of you who have no Meta exposure – I think it gives you a good perspective of Zuck’s thought process and business decisions around the NVIDIA spending, state of AI expenditures, and their open-source strategy with Llama.

My general thoughts from the 2 interviews:

· I don’t know who Zuck hired to be in charge of his rebranding, but he/she is doing one hell of a good job

· (Not anything new) Zuck has been openly firing shots at Apple, lamenting about the unfair practices & lack of innovation due to control

· Which transits to the next stage of Meta’s business execution / long-term strategy – building out the next computing platform (glasses) AND owning (arguably) the next frontier where every business will be on – in the AI space (with their open-source model)

· He does seem to truly enjoy his time, building products with people that he loves to hang around with – and I don’t think that he’s slowing down anytime soon

· Meta is, and will be the King of social media for the foreseeable future;

o but I think we’re witnessing a re-writing of the investment story in real-time

o could Meta really crack the code of the next consumer compute platform

o or could Meta play the role of the foundational software layer (like Android/Windows)

I think it’s still early days, and we should be excited about what the future holds.

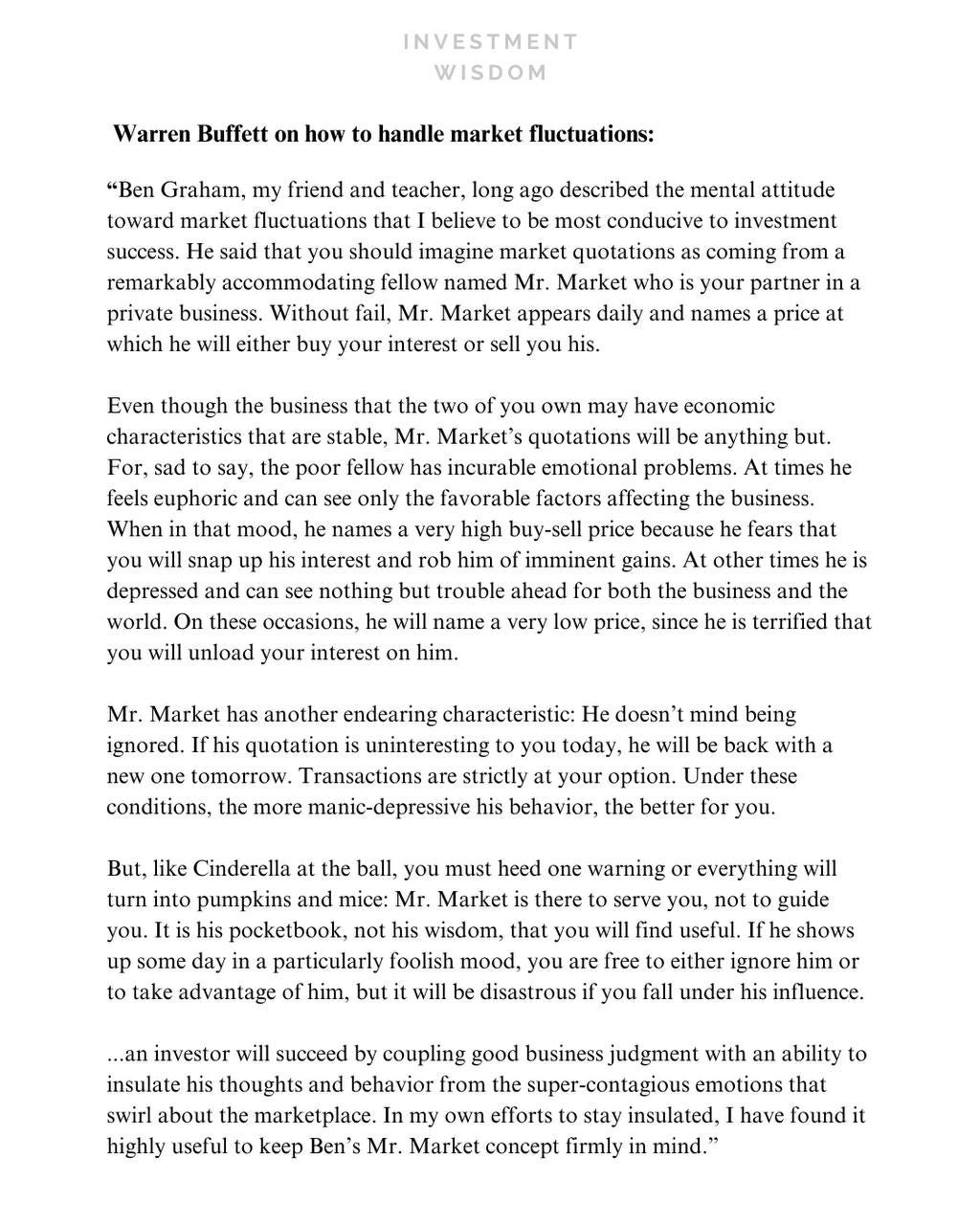

Market Fluctuations

In case you need a reminder, this is Uncle Buffett’s framework for thinking about (Crazy) market fluctuations.

Love,

Chi Keng